WHC connects you to the best loan option for your business.

WHC Lending does not charge broker fees and we do not pull your credit. We connect you to the best financing options possible based on your current situation and the programs offered by our partner network. WHC is here to work with you as your business grows.

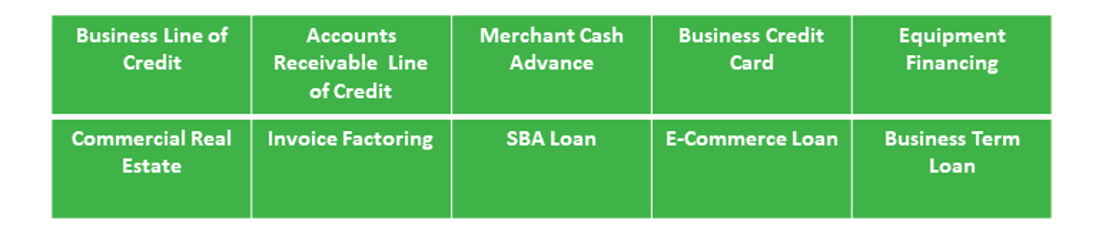

Funding Options:

We offer a wide range of commercial loans and lines of credit to help support your business growth, including:

- Business Term Loan

- Business Lines of Credit

- SBA Loans

- Accounts Receivable Line of Credits

- Commercial Real Estate Financing (including 100% financing options)

- Merchant Cash Advances

- Business Credit Cards

- Equipment Financing

- Invoice Factoring

- E-Commerce Loan

Application Options

Through our relationship with our Commercial Lending Partners, our customers can access affordable financing. We have programs for startups and funding up to $50 million for growing businesses. We also have connections to emergency funding. We can help you with:

- Working capital to support a thriving business

- Funds to grow or expand a business

- Financing for tenant/leasehold improvements

- Low-cost loans to buy an existing business

- Funds for the consolidation of debt

- Emergency Funds

- Commercial Real Estate

- Refinancing Existing Loans

- Real Estate Development

Loan Process

STEP ONE: Complete the Quick App below.

STEP TWO: You will be directed to the Document Upload page. This is where you upload the necessary documents.

STEP THREE: Click here to schedule a complimentary consultation with a Senior Loan Consultant to discuss your options.

STEP FOUR: You gather and submit documents for your loan application. We will follow up with you to assist as needed.

LET’S BEGIN WITH STEP ONE, THE WHC QUICK APP!